Final report for LS19-319

Project Information

Farmers are hesitant to enter specialty grain production without proven markets, while food entrepreneurs are stymied in their development of regional small grain products due to lack of supply from farmers. A solution would improve economic sustainability for participating farmers and processors, improve environmental benefits via the double cropping system used in the South to produce specialty small grains, and engage consumers more with their food system.

We seek to circumvent the chicken and egg paradox of specialty small-grain production by working with farmer and industry partners to create new value chains for baking, brewing, and distilling products made from Kentucky-grown wheat, malting barley, and rye. Our farm-to-loaf and farm-to-bottle objectives require agronomic, economic, and sociological approaches, and a blend of research, Cooperative Extension, and outreach activities. Research on small-grain, and in particular, malting grain, production in the Northeast and Northwest supported the emergence of craft beverage and artisan baking sectors. In the South, while Kentucky is renowned for its distilling heritage, there has been less development of malting grains to support our superlative spirits and rapidly expanding craft beverage sector. Preliminary Kentucky research demonstrated the viability of regionally adapted hard red winter wheat in artisan bread production. Demand is strong; in addition to consumer preferences, a growing number of contractually or legislatively obligated institutions (universities, hospitals, public schools, state parks) seek to purchase Kentucky farm-impact foods for their dining services.

Through previous work, we identified growers, artisan bakers, flour millers, maltsters, brewers, and distillers with whom to partner, bu we likely just scratched the surface. We will perform a value chain mapping procedure that combines key stakeholder interviews, focus groups, enterprise budgeting, and market analysis to identify critical success factors for each market segment. These factors include grain quality characteristics, economic factors of production, logistic or technical considerations across value chain levels from the farm to the retailer, and consumer preferences. In parallel, we will conduct small-plot non-GMO agronomic trials to identify cultivars and breeding lines with sufficient agronomic fitness and superior flavor/malting/baking characteristics. Seed of superior breeding lines will be increased and provided to growers for pilot-scale baking, malting, brewing, and distilling trials. Production performance and sensory evaluation are components of the pilot product evaluations. The results will be shared with our network of partners through print and online media as well as Cooperative Extension programs and publications, industry and academic presentations and publications, and annual Grain Exchanges that will connect our farmer and industry partners with the wider community of interested farm and industry stakeholders. Participants in the Grain Exchanges will share experiences and final products. Speakers from regions with more developed local small grain value chains will share lessons learned. Relative to the existing commodity-oriented value chains, we intend the end results to be self-sufficient networks of farms and businesses that create new economic activity, use environmentally superior farming practices, and give people ways to feel socially connected and rewarded via the food system.

Our SARE grant “Development of Local Small Grain Value Chains for Kentucky and the Mid-South” has benefited our research and outreach efforts tremendously, by giving us a structure and calendar that guide our planning and implementation in the specialty small grains arena. Prior to receiving this grant these efforts were carried out by individuals but we were not always aware of each other’s activities. Further, and possibly more important, this grant has provided a platform for putting us in touch with our stakeholders on something more than a one on one basis. Through advisory committee meetings and field days we stay in continual touch with bakers, distillers, farmers and processors who are deeply interested in these specialty small grain markets.

The purpose of this project was to design, characterize and understand small grain value chains that help farmers capture more value from winter small grain production by meeting local demand from the artisan food and beverage markets. The initial grant team consisted of David Van Sanford, Krista Jacobsen, Jordan Shockley, Leigh Maynard and Lilian Brislen. Dr. Maynard retired mid-way through the grant and Dr. Brislen left UK in the fall of 2021 to take a position at Colorado State University. Dr. Yoko Kusunose replaced Dr. Maynard on the team. We had great help from two additional individuals: Brett Wolff from the Center for Crop Diversification helped immensely with website design, social media presence during the 2019 Grain Gathering along with facilitation roles in two other events. Ashton Wright, who succeeded Dr. Brislen as Executive Director of the Food Connection @ UK, participated in several events over the course of the grant and shared with us her insights and experience from years of working with local food systems.

The arc of this project and its momentum was seriously impacted by the Covid-19 pandemic. Nevertheless, to a person, the team observed a profound surge in interest for local food systems and economies over the course of the grant. It is possible that Covid likely boosted the level of interest in local small grain economies, in the same way that interest in home baking surged, but there is no doubt that connections have been formed and conversations about locally produced specialty small grains now occur easily and often in unlikely places. What follows is basically an enumeration of our activities over the 3 years of the grant, and the products and conclusions that resulted.

November 2018

- Event at South Farm during Steve Jones visit: this was a reception for Dr. Jones, but also a gathering of the partners we knew to be interested in specialty small grain economies

- SARE grant submitted

- Edison hard white spring wheat planted by our Walnut Grove Farms partners in response to baker requests – this cultivar is prized by PNW bakers for its flavor

January 2019

• Grant team visits Cincinnati to meet with partners at Sixteen Bricks, Sotto Restaurant, and New Riff Distillery

February 2019

• DVS visited Maker’s Mark to discuss collaborative research

March 2019

- Rye project planning calls with Dendri Fund partners

- Grant team joins Rye Stakeholder Gathering at Woodford Reserve. Presentations of flavor research, discussion of farmer interest and initial efforts to broaden the scope of the Dendri-Fund rye project

- Grant meets with Beam group to discuss collaborative research

- 2019 Food Connection Local Food Summit – Van Sanford presents on Baguette Project: “Bread Wheat in a Biscuit State?”

April 2019

Funding for SARE grant arrives

- Grant team travels to Nashville (with partners from Walnut Grove Farms) to meet biscuit and pastry chefs to discuss interest in local wheat

- Grant team travels to Asheville,NC for Bread Fair and to meet Jenn Lapidus (Carolina Ground Flour) and Amy Halloran

- Grant team decides to host Southeastern Grain Gathering, Sep. 2019

- Began weekly Southeastern Grain Gathering (SEGG) planning meetings

May 2019

- “A Walk through the Rye Fields” – Walnut Grove Farms hosted grant team and stakeholders and partners in the Rye Project. Collaborative planning of pilot distillation of farmer grown rye by Woodford Reserve and small plot rye by Brown-Forman R&D lab

- Serious SEGG planning continues

- Grant team Attended Great Bagel Grand Opening to see New American Stone Mill produce freshly milled whole wheat flour for bagels

- Grant team meets with VP’s of Southeastern Conference universities, tastes bourbon and discusses small grain value chain work

June 2019

- Jim Betts, owner of Bluegrass Baking helped wheat breeding team with bread wheat harvest, Woodford County

- Grain from desirable wheat breeding lines provided to Bluegrass Baking for experimentation and baking

- Rye Project planning meeting, Brown-Forman headquarters, Louisville

- Serious SEGG planning continues

July 2019

- Walnut Grove Farms (WGF) partner Sarah Halcomb travels to Maine Grain Alliance Kneading Conference on behalf of SARE team

- Dave Van Sanford and Hanna Poffenbarger travel to Loretto to meet with Maker’s Mark grain team to discuss variety trial plots and cover crop plots on MM new farm

- Serious SEGG planning continues

August 2019

- Grant team meets with UK’s Women in Philanthropy to taste bread and discusses various bread and whiskey projects underway

- Countdown to SEGG begins

September 2019

- Rye value chain conference call – grant team and partners

- Barley value chain conference call – grant team and partners

- Wheat value chain conference call – grant team and partners

October 2019

- Provided wheat seed to Bill Keener of Sequatchie Cove Farm in TN and Laura of Mt. Folly Farms in Winchester

- Connected organic grower Ben Abell with seed source so he could plant Purplestraw wheat and Dylan rye

- Planted wheat variety trial at Maker’s Mark, Loretto, KY

- Submitted small plot rye samples to Aaron MacLeod at Hartwick College for quality analysis

- Submitted small bulks of 3 small plot rye cultivars to Chris Teeley at Brown-Forman R&D lab for micro distillation

December 2019

• Began planning lunch for rye growers

January 2020

- Winter wheat meeting, Princeton KY. Jordan Shockley presented on enterprise budgets for specialty small grains, Dave Van Sanford presented on SE Grain Gathering. More than 100 commodity farmers were present and survey response indicated some interest in growing wheat for artisan bakers, rye for whiskey and malting barley for brewing or distillation

- Rye farmer luncheon at Rye on Market in Lousiville. WGF-produced Brasetto rye milled in Bob Perry’s lab on campus and shipped to Blue Dog Bakery in Louisville to produce a rye miche for the event. Farmer experiences discussed; small plot rye data presented.

- Helped WGF partners find commercial homes for their Edison hard white spring wheat

February 2020

- Chef Bob Perry begins using Edison HWS wheat for all of the bread served in UK’s Lemon Tree restaurant

- Jane Bowie and Beth Buckner from Maker’s Mark come to evaluate aroma and flavor of porridge make from UK wheat breeding lines

- 2020 Local Food Summit February 26

Farm to Bottle Session: Kentucky grains for Kentucky distilling – Panel discussion I involving grant team participants from UK, Walnut Grove Farms and American Farmland Trust

Farm to Loaf Session: The Approachable Loaf – poster presented by Sarah Halcomb1, Jim Betts2, Andy Brown2, Steve Jones3, Bryan Brady4,Bob Perry4 and Dave Van Sanford4 1Walnut Grove Farms , 2Bluegrass Baking, 3The Bread Lab, 4University of Kentucky

- 2020 Beam Inst. Conference February 27

Van Sanford Chaired Grains presentations:

Speakers:

> Russell Case, Malster & Owner, South Fork Malthouse

> Sam Halcomb, Owner/Farmer, Walnut Grove Farms

> Erica Fields, President, Brooks Grain LLC

> Joyce Nethery, CEO/Master Distiller, Jeptha Creed

Immediately after the Beam Institute Conference, Covid-19 struck and in person gatherings were suspended.

- Complete a participatory value chain maps for rye, barley, and wheat in Kentucky.

- Develop and implement production process activities that resolve challenges in growing and marketing wheat, rye, and malting barley with flavor and quality characteristics desired by artisan food and craft beverage producers.

- Foster cross-sector understanding among value chain stakeholders with the aim of supporting strategic product development, entrepreneurial efforts, and future research and technical assistance initiatives.

Cooperators

- - Producer (Researcher)

- - Producer (Researcher)

- - Producer (Researcher)

Research

Wheat plots including strong gluten types were planted at four locations throughout the state to be evaluated for breadmaking quality in late summer and fall. Malting barley was planted at two locations for evaluation as malt used in brewing and distilling and rye plots were planted at three locations for agronomic testing and post-harvest quality evaluation. All of these plots relate to our project objective 2: Develop and implement production process activities that resolve challenges in growing and marketing wheat, rye, and malting barley with flavor and quality characteristics desired by artisan food and craft beverage producers.

Small grain harvest has just been completed across the state. We will gather on a nearby farm with our advisory committee on September 24 to continue discussions on the specialty small grain value chain and gather feedback from our stakeholders on ways to strengthen and sustain this value chain.

Partner Interviews During 2020 (Carried out by Brislen and Maynard)

Interviews: The goal of objective 1 (mapping the value chain) was to identify critical success factors for specialty small grain markets to flourish in Kentucky. As a first step toward this goal, the SARE team conducted interviews with end-users of specialty small grains. These end-users included millers, maltsters, bakers, brewers, and distillers. Overall, we formally interviewed ten end-users (17 interview participants; Table 1) representing at least one from each of the categories mentioned above. Each interview was in-person and lasted 1-1.5 hours. We followed a semi-structured protocol that asked questions regarding the past, present, and future opportunities for specialty small grains grown in Kentucky (See Appendix 1 for interview protocol and sample questions). From these interviews, five themes arose:

1.) DEMAND: The strongest demand is from bakers and distillers; however, emerging enterprises in both milling and malting will demand more specialty small grains soon.

- Kentucky’s first malt house is expected to commence operations by barley harvest 2020 in Harrison County, Kentucky. Currently, the closest malt house for Kentucky producers is Riverbend Malt House in Asheville, NC.

2.) QUALITY: Grain quality standards for specialty grains are more stringent and less flexible than those for commodity grains. Moreover, these standards must be communicated to the end-users.

- Grain quality standards begin with USDA No. 1 Grade standards, with additional specifications for brewers and distillers.

- Quality labs for testing malt for brewers and distillers are located out of state.

- If quality standards are not met, an alternative market must be identified (e.g., animal feed).

3.) STORAGE: On-farm storage will be required to allow for just-in-time delivery to processors and other purchasing entities.

- Aggregators exist that will buy and store specialty grains (e.g., Brooks Grain in Jeffersonville, IN).

4.) FLAVOR: Flavor profiles of the grains are important; variety selection will necessarily encompass more than yield and disease-resistance.

- Variety selection will also include alcohol yield for distillers and brewers.

5.) RELATIONSHIPS: All stakeholders valued both professional and interpersonal relationships with farmers and suppliers. These relationships build a story that helps brand products and link the product back to Kentucky farms and their sustainable practices.

- Stakeholders are willing to work with farmers to ensure fair compensation and risk-mitigation when trying new or specialty grains.

- Stakeholders are looking to build a long-term, win/win relationship with farmers.

Details of the interview process are provided below.

|

Stakeholder Category |

Number of Enterprises represented |

Number of Interview Participants |

|

Millers |

3 |

4 |

|

Maltsters |

Cannot disclose |

Cannot disclose |

|

Bakers |

3 |

3 |

|

Brewers |

2 |

2 |

|

Distillers |

3 |

7 |

Table 1. Stakeholder interviews performed as part of the value chain mapping process.

Interview Protocol

INTRO

We’ve prepared a series of questions that cover different dimension of small grain purchasing, assessment, usage, and possible future use.

It’s totally fine and understandable if you don’t know some of the answers – we’re covering a lot of ground as we try to map out the value chain.

We’re also happy to be as specific or general as feels comfortable to you – meaning, we don’t want to reveal any trade secrets. I totally understand if you’d like to pass on a question or circle back at some other time.

We’re just here to get a sense of what we should take into consideration as we’re working with everyone across the small-grain value chain to develop seed stock, farm management practices, or different ways of assessing and managing small-grains that will open up as many chances for innovation or creativity as possible.

Business Basics

- Can you give me the readers digest version of the story of this business? (history, product lines, what markets to they sell into (local, national, global)

- What distinguishes your company’s products or brand from others?

- How strongly is the company’s identity or brand tied to “Kentucky”?

- How would you describe your typical or best customer?

Grain Basics

- What small-grains does you company use (wheat, barley, rye), and how do you use them?

- Where are you currently sourcing those grains from?

- Direct from a farm, from a merchandiser such as a grain elevator, or from an intermediate processor, such as a miller or malthouse?

- Are any of your grains currently coming from Kentucky?

- If you are not already buying raw product from farmers, are there any plans to do so in the future?

- Do you buy grain through contracts with suppliers, on the open market, or through some other pricing method?

- Speaking in generalities, how is price you pay for grain, flour, etc. determined?

- Who pays for transportation, and are you taking deliveries or picking it up yourself?

- What’s your Plan B for grain sourcing?

- What options are available if you source grain that does not meet your needs (e.g., discounts, change supplier, adapt recipes, etc.)

Volume and Storage

It’s not secret that the volume of purchasing by any given producer drives a lot of other considerations for small-grain supply chains.

- Can you give me a rough idea of what sorts of volumes of each of the small-grain your purchasing, and does that fluctuate over the course of the year?

- Do you or your suppliers consider yourself a small, medium, or large grain buyer?

How about storage? How do you all receive your small-grains, and what sorts of storage infrastructure (if any) do you have at your facilities? How often does that stored small-grain inventory turnover?

Quality Standards

- How do you assess the quality of the small-grains you work with?

- Are there industry standards, or do you have any unique or extra requirements?

- We’re not looking for trade secrets, just to know if standards vary by manufacturer

- Thinking about the quality assessment measurements, what aspects of your product or your production process do they affect? Meaning, why are they important?

- For your products and business, what are the tolerances for variation in grain delivery schedules, quantity, and storage?

- How much do those dimensions of ‘quality’ impact the flavor of your product, or other distinguishing characteristics?

Specialty grains/products

As you know, our research is looking specifically at Kentucky-grown small grains. One question we’re particularly interested is what – if any- unique value can Kentucky-grown grains bring to the table (pun intended).

- Can you walk me through a time you company experimented with a special product or unique offering?

- How did the decision to explore that product come about?

- Who was involved, and how did the decision making happen?

- Did you encounter any unique barriers or challenges?

- Did you ultimately move ahead to production, or did it end in the development stage?

- What did you learn?

- Do you currently order and premium or specialty small-grains to meet specific needs/goals? Have you ever considered doing so?

- What kids of specialty standards or needs do you have? What do they bring to your product?

- Thinking both of general characteristics and specialty grains, what quality benchmarks would Kentucky grains need to meet to be suitable for your products (moisture content, protein content, baking properties, others)?

- Is small-batch production typical or feasible? What is the lower limit of grain purchases you can make in your operation?

Kentucky Value-add

- How strong do you think your customers’ demand is for products using Kentucky grains?

- Are there other value-added product attributes that your customers demand more?

- Would some local grain products be more attractive to customers than others?

- What information do you need to make a business decision about whether to source grain (or flour or malt) from Kentucky?

Looking to the future

- What aspects of the business are really dialed in, and where do you see areas of growth or experimentation?

- Do you see a place of Kentucky-grown grains in any piece of that growth or innovation?

Misc

- What other barriers to sourcing Kentucky grains are we not thinking of?

- Given your expertise in your business compared to our lack of familiarity, what issues have we not yet talked about that we should be paying attention to?

August 2020

- John Bell of Elmwood Stock Farm – gave him half of our Purplestraw seed so he can grow an increase for New Riff distillery. We also shared rye data with him and the consequence of that was that he ordered a bunch of seed of the rye variety Dylan from NorthDakota. John also plans to join the rye project this fall as does Ben Abell.

- Rodney Wedge of Ashebourne farm (who is also involved with the rye project) wants to grow some bread wheat on 15 acres; grant team helped him locate seed.

October 2020

- Work with Maker’s Mark continues. Wheat plots moved onto the distillery campus this fall to be part of the tour experience. On the adjacent farm (where the plots were last year) Jane Bowie and her team have decided to grow Pembroke 2016 and a Pioneer variety 26R36 based on sensory analysis of those two varieties from our plots on the farm this summer.

Makers has been working with Riverbend Malt in TN and Southfork Malt in KY on special projects with malted barley.

- Sam Halcomb of Walnut Grove Farms has provided some Violetta barley to RT Case of Southfork for malting and RT has been growing his business with local brewers

January 2021

- The Neighbor Loaf project, developed by the Artisan Grain Collaborative is put into action. Bluegrass Baking will bake and slice Neighbor Loaves with 50% local whole wheat and customers who buy these loaves will donate them to God’s Pantry food bank.

- New wheat breeding graduate student Paula Castellari is working hard on sensory analysis of aroma of UK breeding lines; we hope to start baking in February.

The winter of 2021 was still a time of remote work, remote class at UK and a time when in-person gatherings involving UK personnel were largely prevented according to state COVID mandates. By summer, things were beginning to relax and so we planned a gathering at a nearby farm in Sepember.

The grant team gathered on September 17 at the farm of one our farmer-cooperators on the grant, Hoppy Henton where we were joined by approximately 20 growers, several distillers, bakers and a maltster along with a farmer/miller from the very successful IL enterprise, Janie’s Mill. The plan was to carry out a value chain mapping exercise(Lilian Brislen, Krista Jacobsen) to see if we could identify pinch points and opportunities within the chains. Secondly we (Yoko Kusunose) engaged the stakeholders in an exercise using the “Slido” (https://www.slido.com/) a live polling phone app, in an effort to discover price points for bread wheat and rye among KY stakeholders. The meeting agenda follows:

- Welcome (20 min)

- Thank our sponsors (5 min)

- Goals and Ground Rules: (5 min)

- Goals

- Foster connections between KY small grain value chain actors

- Broaden and deepen our understanding of the activities, goals, and challenges of different value chain actors

- Identify key areas for future research and programing to support continued development of small grain value chains

- Ground Rules

- Sit at a different table for each session

- Follow the same process for each grain

- There will be a little repetition, but the small differences between the grains matter

- It’s important that everyone in the value chain shares their perspective and experience

- Overview and instructions (10 min)

- Mapping

- Slido

- Quality dot map

- Session 1: Wheat (60 min)

- Update from the field: (15 min)

- What was the most significant development of the last year?

- What opportunity or challenge is top of mind headed into the next season?

- Mapping Exercise (25 min)

- Report back (10 min)

- Any new insights gained through the process?

- Slido (5 min)

- Tasting Intro (5 min)

- Update from the field: (15 min)

- Break (tasting during break) (15)

- Session 2: Barley (30 min)

- Update from the field (10 min)

- ??

- Mapping Exercise (15 min)

- Slido (5 min)

- Tasting intro (5 min)

- RT Case, owner of South Fork Malt House brought beer brewed with his malt (from KY barley) to taste

- Break (15 min)

- Session 3: Rye (45 min)

- Update from the field (10 min)

- Mapping Exercise (20 min)

- Slido (5 min)

- Tasting Intro (5 min)

- Closing Discussion (30 min)

- What new insights or information did you gain through this process?

- Does anyone have a new understanding of a member of the value chain?

- Did you see any overlap or synergy in challenges or opportunities across stakeholders?

- Are there areas where additional coordination and communication might help?

- What does small-grain success look like for the different actors across the value chain?

- Scientists

- Farmers

- Processors

- Manufacturers

- Eaters

- Update from the field (10 min)

- Goals

The slido exercises let to a write-up entitled: Cereal rye and hard red winter wheat: Price discovery. This document can be found under “Deliverables” at the end of the report.

In addition to the planned exercises which engendered much discussion and interaction, some of the most valuable outcomes were the connections that resulted from one on one conversations. For example, a local organic grower was introduced to bagel shop owners who were interested in sampling his grain. The other highlight of the meeting was the attendance of farmer/miller and owner of Janie’s Mill. He shared with the group his experiences and how the Pandemic was actually a shot in the arm for his business.

Educational & Outreach Activities

Participation Summary:

Events held to address these objectives

Work on each of these objectives was ongoing before the grant was approved for funding. Given the groundwork that had been accomplished in the way of building relationships over the three years prior to the grant, we have made the most progress on our third objective. Several events were held during the first year of the grant that facilitated network-building efforts.

In May we gathered at Walnut Grove Farms, one of our partner farms, to host a field day on our wheat, barley and rye efforts. There was excellent participation, from growers interested in specialty small grains, to processors and end users, in addition to the SARE team. At that event we were able to recruit several individuals to participate in the Southeastern Grain Gathering (SEGG, https://localgrains.ca.uky.edu/segg) held in Lexington, September 15-16. Approximately 170 people attended the SEGG, including growers (conventional and organic), maltsters, millers, bakers, brewers and distillers. Among the highlights of the event were the discussion sessions for each of the three value chains– rye for distilling, malting barley for brewing and distilling, and wheat for artisan baking. Roughly 35 individuals participated in each of these conversations, which featured the viewpoints and perspectives of all parties along the value chain. These sessions were facilitated by the SARE team and included anyone with a potential interest in the value chain. We discussed production practices (Objective no. 2 above), grower and end-user needs and the thorny issue of pricing. Lastly, in January of 2020 there were two events that brought growers together to discuss production practices and prices:

1) Winter wheat growers meeting, January 7, Princeton KY. SARE team members presented enterprise budgets for specialty small grains and shared insights from the SEGG. There were more than 100 farmers present and we included a survey question to determine grower interest in specialty small grains. The survey response indicated some interest in growing wheat for artisan bakers, rye for whiskey and malting barley for brewing or distillation. 2) Rye farmer luncheon, January 31, Louisville, KY. The 4 farmers who participated in the rye project—which involved growing 25 acres of rye according to recommended production practices--gathered to discuss lessons learned. We took rye produced on one of the farms, milled it in a lab on UK campus and shipped it to Blue Dog Bakery (Louisville), one of our bakery partners, to produce a rye miche for the event. Farmers discussed their rye production experiences and also tasted and evaluated the bourbon distillate produced from rye grown on three of the farms. We shared small replicated-plot rye data with growers and discussed plans for the next production year. This effort has initiated an attempt to create a new crop in Kentucky: rye for distillation.

Organized by team members Brislen and Jacobsen, the Kentucky Local Food Systems Summit brought together more than 200 individuals including farmers, chefs, processors, end users, educators and researchers. Other grant team members participated in sessions on the Rye Project – an effort to develop Kentucky rye into a viable crop for the distilling industry, and presented a poster on The Approachable Loaf – nutritious, healthy, affordable bread for everyone. That evening (February 26, 2020) our grant team met with the Advisory Committee for a working dinner. During that session, plans for the upcoming cropping season and beyond were discussed, and difficult topics were broached, like the thorny problem of creating a value-added system where all players share the added value. The feeling among advisory committee and grant team members as we departed was that connections among the farmers and small grain industry partners had been deepened and strengthened and there was an optimism about our goal of building a sustainable specialty small grain value chain - and then Covid-19 struck.

Plans to attend a multi-bakery evaluation of locally adapted varieties in Madison, WI, organized by the Artisan Grain Collaborative, were put on hold as was our June event - a twilight field tour/evaluation of bread loaves baked from locally adapted wheat and newmade distillate. Instead the team kept in touch with our growers, processors and end users through virtual meetings and email, and very rarely, in-person socially distanced meetings outside in a wheat field for example.

2022 Grains Events

February 8 – Winter wheat growers meeting, Hopkinsville

March 1 – Kentucky Small Grain Growers Board meeting, Elizabethtown

March 14 – Krista Jacobsen led a group of Sustainable Agrculture students to visit collaborative research between Grant Team and Maker’s Mark team

May 10 - Wheat Science Field Day, Princeton, KY

July 17 meeting in Cynthiana, KY to visit SouthFork Malthouse (https://www.southforkmalthouse.com/). This malthouse was still in the planning stages in the earliest phase of the SARE grant and it was a struggle, with the combination of the pandemic and having to convince local craft brewers that they might want to try some local craft malt. Concurrently, our grant team struggled to convince the local brewing community to interact and partner with us. All of that changed, in a good way, at this meeting. RT Case, malthouse owner, explained the workings of the malthouse to approximately 20 individuals including the grant team, growers, distillers and two brewers from Louisville. It was especially gratifying to interact with these brewers who were already using this local malt in their formulations and who saw great value in local barley that was locally malted; this was the first interest expressed to the grant team since we began these conversations in 2018. After the malthouse tour we had a great conversation that was facilitated by Brett Wolff. Subsequently the grant team met with the Kentucky Brewers Guild representative and made plans for future interactions.

July trip to the Maine Keading Conference – WGF partner Sarah Halcomb, UK Chef Bob Perry and Dave Van Sanford traveled to Skowhegan Maine for this conference. This was a transformational event in that it crystallized the thinking of the grant team about the path forward. The Maine Grain Alliance was holding its 15th annual Kneading Conference and it suddenly became clear to us that for sustained progress in the local specialty small grains economies arena, an entity outside the university needed to take the lead. With this in mind, we convened the final event to be held under the auspices of the SARE grant.

September meeting in Franklin

On September 12, 2022, about 25 individuals gathered in Franklin, KY, in the heart of Kentucky’s small grain production area to help the grant team reflect on where we had been and what our next steps might be. Our SARE grant was to end soon and how did we intend to hold our fledgling community together? As it turned out, our trip to the Maine Kneading Conference had laid the path for us. It was clear from our trip to Maine that the energy had to come from within the small grains community rather than the University of Kentucky. We had observed how well the Maine group functioned and how energetic they still were after 15 consecutive years of Kneading Conferences. And so it was that we resolved to form what is now named The Ohio Valley Grain Exchange. Sarah Halcomb of Walnut Grove Farm agreed to be the Coordinator.

Minutes of the meeting, recorded by Ashton Wright, follow.

Notes

Attendees:

Dave Van Sanford - UK, Bob Perry - UK, Krista Jacobsen - UK, Ashton Wright - UK, Tim Phillips - UK, Lauren Brzozowksi - UK, Bill Bruening - UK, Chad Lee - UK, Sarah Halcomb, John Halcomb - Farmer, Sam Halcomb - Farmer, Stephanie Halcomb - Farmer, Jay Snoddy - Farmer, Chris Kummer - Farmer, RT Case - Maltster, Steve Whitledge - Distiller, Shawn McCormick - Distiller, Denny Potter - Distiller, Marc Dottore - Distiller, Jane Bowie - Distiller, Brian Mattingly - Distiller, Mandi Lineberry - Baker, Ryan Morgan - Baker, Barbara Hurt - Dendri Fund

Sam Halcomb–value chains = taking traditional supply chains to the next level

Maine Kneading Conference – recap

- Hosted by ME Grain Alliance→this is what we need in KY

- Allagash Brewing

- 50K barley/year→1 million lbs in 5 years

2019 Southeastern Grain Gathering reflections + where we are going

- Southern SARE coming to a close but doesn’t mean work is ending–understanding opportunities/challenges around specialty small grains for local markets

- Wheat, barley, and rye

- 170 folks in attendance at Grain Gathering–farmers, maltsters, distillers, brewers, bakers→modeled after Grain Gathering in WA State

- Highlights:

- Ability of this group to come together around addressing challenges in the value chain (pricing, quality, secondary markets, etc.)

- Lessons learned:

- Value of story/source identification (where do the grains come from, who is growing them, etc.)--what is the best way to facilitate this on an on-going basis?

- Role of flavor + function–varies by commodity, what does quality look like? What happens when it doesn’t meet spec? What do secondary markets look like?

- Infrastructure needs/bottlenecks–what infrastructure is needed by sector?

- 350 farmers, 30+ ag professionals have been involved in this work

Challenges/opportunities moving forward with a Grain Alliance

- Communication – how to keep conversation going

- Membership – how do we grow this group, how do we set goals, how do we get new folks plugged in?

- Rating/star system in ME that indicates how many local inputs you have–managed by the grain alliance (1-5 stars)

- What are the goals? How do we scale?

- Challenge–need for quality processing/milling (middle processing) needed for food quality crop--they are at the scale they need their own mill, but it’s expensive

- What is milling capacity in KY?

- Seimer Milling (Hopkinsville)

- Weisenberger (Woodford Co.)

- Great Bagel (mill their own flour and could do some contract milling)

- What differentiates our local product? How do we know we have a superior product?

- Is our story sufficient?

- Is there a consumer pull to have local inputs sources from already “Kentucky” products like Kentucky bourbon?

- Depends on scale–if just selling to KY yes, if selling outside, no.

- Transportation scale/logistics challenging

- Barley is a better fit (over wheat) from an agronomic perspective because it can be harvested earlier

- Challenge: test weight

- Is it of spec to be malted?

- Does vertical integration make sense?

- From someone purchasing all local grains→shorter/more reliable supply chains, knows suppliers personally, smaller footprint, from a sustainability point of view

- Maltster needs more of a commitment before he invests in more infrastructure

- Need to build demand outside of KY for KY small grains

- Are there enough markets inside KY?

- Need to keep scale and consumer education in mind

- Baker–depth of flavor for freshly milled flour makes a huge difference

- Marketing + relationships make a difference in selling to local markets–some buyers willing to pay a premium for “local”/ “fresh” but at the end of the day it's a commodity

- How do we get more barley grown in KY?

- How do we build relationships w/ brewers/distillers association around processing/infrastructure + connectivity needs?

- There is a limit to the value of the story if the quality and economics aren’t there

- Service makes a difference (what service local farmers offer is key)

- Should smaller distillers/brewers band together on marketing efforts around local purchasing/inputs?

Breakout discussion:

Do we want to form a KY/Ohio Valley Grain Alliance? If so, what should it look like?

- Building connections – connectivity across networks and w/interested parties and with consumers

- Building a blueprint for passionate people to build out the business plan

- Offering education + facilitation of conversations–consumers, farmers, processors, buyers

- Quality products need quality ingredients–product differentiation is key

- Identify demand pull

- Buyers need to value local AND demand it

- Help create scale to bring the product to reality

- Variety development

- Help create resilience in supply chain

- Infrastructure development + support for bottlenecks along the value chain

- Sustainability = good business sense

- Help create scale – build demand, scale production appropriately

- Value proposition–freshness, sustainable, Kentucky!

- Marketing/branding campaign

- Identify support for risk management/mitigation

- Need to develop a collective vision on what success looks like?

- Host events that support that vision/strategic plan

- We need a mill before we do anything–how to size it?

- Where is it located?? Between Etown and Versailles?

- Storage

- Transportation

- retail/distillers + brewers/bakers

- Research to decide how big mill should be

- A flour mill might make sense to start, distilleries likely need hammer mills

- Who teaches milling?

- ME Grain Alliance has a mill

- 16 Bricks – whole grain baking – open to teaching, allow folks to use the mill

- Alliance could:

- Host a website/clearinghouse w/resources, markets, directory, map of farmers/processors/buyers (Dave may already have this in development)

- Convene stakeholders to better understand the needs/bottlenecks/opportunities

- develop a shared marketing approach/platform

- identify funding opportunities

- KADF would be a good funder to approach for this Alliance

- Develop a star rating so that consumers could identify “how local” each business is in terms of purchasing

- Connect w/other trade groups (KDA, KBG, etc.)

- Value-chain coordination

- Coordinate communication around supply/demand

- Potential structure:

- Executive Director + Board

- Annual meeting

- Phased development:

- Identify a central point of contact who can build the rolodex, define needs, and where do we want to start?

- Develop a scope of work with strategic goals + scale staffing

- Start with smaller scale buyers?

The grant team is profoundly grateful to Southern SARE for their support.

A list of deliverables follows.

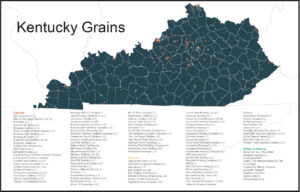

Kentucky Grain Map (Developed by Brislen and Breen; interactive version can be found at https://localgrains.ca.uky.edu/grain-map)

Specialty Small Grains Enterprise Budgets (https://localgrains.ca.uky.edu/budgets/specialtygrain-doublesoy) (Shockley and Maynard)

|

Specialty Small Grains and Double-Crop Soybean Budgets 2019-2020 |

|

Purpose: This Decision Aid has been constructed to help budget for specialty small grains double-crop soybean production. |

|

Options Evaluated: No-Till Hard Red Winter Wheat and No-Till Soybeans, No-Till Barley and No-Till Soybeans, No-Till Cereal Rye and No-Till Soybeans |

|

Notes for Specific Sheets |

|

Machinery Calculation Sheet: Use this sheet if you want your machinery-related costs calculated based on the publication "Custom Machinery Rates Applicable to Kentucky". These estimates include fuel, labor, repairs, overhead and depreciation. Otherwise, you enter your estimates directly in the budgets. When using this sheet follow the specific instructions noted directly in the sheet itself. You can change the base fuel price, labor rate(s), trucking distance, and other parameters (highlighted in blue). Finally, you can also increase or decrease the calculated rates by your specified percentage. To use these calculations, make sure to answer "yes" to the question "Calculate Machinery Related Costs" in each budget. |

|

No-Till Hard Red Winter Wheat and Double-Crop Soybean Sheet: Enter fertilizer (N,P,K) on an elemental (unit) basis. User can either estimate their own machinery-related costs or have them calculated based on the publication "Custom Machinery Rates Applicable to Kentucky" (see above). To have them calculated, enter "Y" to the question "Calculate Machinery Related Costs?". |

|

No-Till Barley and Double-Crop Soybean Sheet: Enter fertilizer (N,P,K) on an elemental (unit) basis. User can either estimate their own machinery-related costs or have them calculated based on the publication "Custom Machinery Rates Applicable to Kentucky" (see above). To have them calculated, enter "Y" to the question "Calculate Machinery Related Costs?". |

|

No-Till Cereal Rye and Double-Crop Soybean Sheet: Enter fertilizer (N,P,K) on an elemental (unit) basis. User can either estimate their own machinery-related costs or have them calculated based on the publication "Custom Machinery Rates Applicable to Kentucky" (see above). To have them calculated, enter "Y" to the question "Calculate Machinery Related Costs?". |

|

Calculating Machinery-Related Costs |

|||

|

|

|

|

Instructions for Using Machinery-Related Cost Estimates: |

|

Inc./Dec. Calculated Machinery Costs |

Increase |

|

Select "Increase" or "Decrease" if you want to adjust calculated machinery related costs. |

|

Percent Inc. or Dec. Machinery Costs |

20% |

|

Enter % increase or decrease in machinery related costs. |

|

Fuel Cost ($/gallon) |

$2.50 |

|

Enter average on-farm diesel fuel price expected for machinery operations. |

|

Own Labor Cost ($/hr) |

$15.00 |

|

Enter operator labor rate - what you think your time is worth. |

|

Count Own Labor as Variable Cost? (Y/N) |

Y |

|

Enter "Y" if you want your own labor to be a variable cost or "N" if you want it to be a fixed cost. |

|

Hired Labor Cost ($/hr) |

$12.50 |

|

Enter hired labor rate. |

|

Hired Labor (% of Overall Hrs) |

0% |

|

Enter hired labor hours as a percentage of overall labor hours (operator + hired). |

|

Trucking Grain (one-way miles) |

25 |

|

Enter average distance (one-way miles) to truck grain to elevator or other delivery point. |

|

|

|

|

|

Field Operations Included in Machinery-Related Calculations

No-Till Hard Red Winter Wheat/Barley/Cereal Rye and Double-Crop No-Till Soybeans: P, K, and Lime Applications

Six total herbicide/insecticide/fungicide applications Nitrogen Application

No-Till Planting

Post-Emergence Herbicide Application Harvesting

Combine Trucking

|

No-Till Hard Red Winter Wheat \ Double-Crop Soybeans, Per Acre Costs and Returns |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

Quant. |

Unit |

Price |

|

Total |

|

|

Gross Returns Per Acre |

|

||||||

|

|

Hard Red Winter Wheat |

75 |

bu |

$7.00 |

|

$525.00 |

|

|

|

Soybeans |

40 |

bu |

$9.20 |

|

$368.00 |

|

|

|

Crop Insurance Payment |

1 |

acre |

$0.00 |

|

$0.00 |

|

|

|

Gov't Program Payment |

1 |

acre |

$5.00 |

|

$5.00 |

|

|

Total Revenue |

|

|

|

|

$898.00 |

||

|

|

|

|

|

|

|

|

|

|

Variable Costs Per Acre |

|

||||||

|

|

Seed (Hard Red Winter Wheat) |

135 |

lbs |

$0.70 |

|

$94.50 |

|

|

|

Seed (Soybean) |

1.00 |

bags |

$55.00 |

|

$55.00 |

|

|

|

Nitrogen1 |

100 |

units |

$0.43 |

|

$43.00 |

|

|

|

Phosphorous (P2O5) |

75 |

units |

$0.40 |

|

$30.00 |

|

|

|

Potassium (K2O) |

60 |

units |

$0.33 |

|

$19.80 |

|

|

|

Other Fertilizer |

0 |

units |

$0.00 |

|

$0.00 |

|

|

|

Lime - Delivered and Spread |

0.50 |

ton |

$20.00 |

|

$10.00 |

|

|

|

Herbicides |

1 |

acre |

$90.00 |

|

$90.00 |

|

|

|

Insecticides2 |

1 |

acre |

$5.00 |

|

$5.00 |

|

|

|

Fungicides2 |

1 |

acre |

$5.00 |

|

$5.00 |

|

|

|

Fuel and Lube |

1 |

acre |

$0.00 |

Calculate Machinery Related Costs? |

Y |

$25.67 |

|

|

Repairs |

1 |

acre |

$0.00 |

$56.14 |

||

|

|

Hired Labor |

1 |

acre |

$0.00 |

$0.00 |

||

|

|

Operator Labor (Variable Only) |

1 |

acre |

$0.00 |

$42.30 |

||

|

|

Machinery Rental |

1 |

acre |

$0.00 |

|

$0.00 |

|

|

|

Custom Work |

1 |

acre |

$0.00 |

|

$0.00 |

|

|

|

Drying(Hard Red Winter Wheat): LP, Electri |

1 |

gallon LP |

$2.00 |

Pts Remove |

1.0 |

$3.13 |

|

|

Crop Insurance3 |

1 |

acre |

$30.00 |

|

$30.00 |

|

|

|

Cash Rent4 |

1 |

acre |

$0.00 |

|

$0.00 |

|

|

|

Other Variable Costs |

1 |

acre |

$10.00 |

|

$10.00 |

|

|

|

Operating Interest |

$470 |

dollars |

6.0% |

# Months |

8 |

$18.78 |

|

Total Variable Costs Per Acre |

|

|

|

|

$538.31 |

||

|

|

|

|

|

|

|

|

|

|

Return Above Variable Costs Per Acre |

$360 |

||||||

|

|

|

|

|

|

|

|

|

|

Budgeted Fixed Costs Per Acre |

|

||||||

|

|

Operator Labor (Fixed Only) |

|

|

$0.00 |

See Question Above |

$0.00 |

|

|

Machinery Depreciation and Overhead |

|

|

$0.00 |

$91.48 |

|

|

|

Taxes and Insurance |

1 |

acre |

$5.00 |

|

$5.00 |

|

|

Other Fixed Costs |

1 |

acre |

$5.00 |

|

$5.00 |

|

Return Above All Specified Costs |

$258 |

|||||

Footnotes:

1 Assumes urea (NH2). Adjust as needed for other forms of nitrogen.

2 Scout to detect any insect or disease problems and control as required.

3 Crop insurance varies substantially by policy type and coverage level.

4 Cash rent varies substantially by productivity level and region in Kentucky.

|

No-Till Barley \ Double-Crop Soybeans, Per Acre Costs and Returns |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

Quant. |

Unit |

Price |

|

Total |

|

|

Gross Returns Per Acre |

|

||||||

|

|

Barley |

85 |

bu |

$8.00 |

|

$680.00 |

|

|

|

Soybeans |

43 |

bu |

$9.20 |

|

$395.60 |

|

|

|

Crop Insurance Payment |

1 |

acre |

$0.00 |

|

$0.00 |

|

|

|

Gov't Program Payment |

1 |

acre |

$5.00 |

|

$5.00 |

|

|

Total Revenue |

|

|

|

|

$1,080.60 |

||

|

|

|

|

|

|

|

|

|

|

Variable Costs Per Acre |

|

||||||

|

|

Seed (Barley) |

135 |

lbs |

$0.60 |

|

$81.00 |

|

|

|

Seed (Soybean) |

1.00 |

bags |

$55.00 |

|

$55.00 |

|

|

|

Nitrogen1 |

100 |

units |

$0.43 |

|

$43.00 |

|

|

|

Phosphorous (P2O5) |

75 |

units |

$0.40 |

|

$30.00 |

|

|

|

Potassium (K2O) |

60 |

units |

$0.33 |

|

$19.80 |

|

|

|

Other Fertilizer |

0 |

units |

$0.00 |

|

$0.00 |

|

|

|

Lime - Delivered and Spread |

0.50 |

ton |

$20.00 |

|

$10.00 |

|

|

|

Herbicides |

1 |

acre |

$90.00 |

|

$90.00 |

|

|

|

Insecticides2 |

1 |

acre |

$5.00 |

|

$5.00 |

|

|

|

Fungicides2 |

1 |

acre |

$5.00 |

|

$5.00 |

|

|

|

Fuel and Lube |

1 |

acre |

$0.00 |

Calculate Machinery Related Costs? |

Y |

$25.05 |

|

|

Repairs |

1 |

acre |

$0.00 |

$54.94 |

||

|

|

Hired Labor |

1 |

acre |

$0.00 |

$0.00 |

||

|

|

Operator Labor (Variable Only) |

1 |

acre |

$0.00 |

$42.11 |

||

|

|

Machinery Rental |

1 |

acre |

$0.00 |

|

$0.00 |

|

|

|

Custom Work |

1 |

acre |

$0.00 |

|

$0.00 |

|

|

|

Drying(Barley): LP, Electric, Maint & Labo |

1 |

gallon LP |

$2.00 |

Pts Remove |

1.0 |

$3.54 |

|

|

Crop Insurance3 |

1 |

acre |

$30.00 |

|

$30.00 |

|

|

|

Cash Rent4 |

1 |

acre |

$0.00 |

|

$0.00 |

|

|

|

Other Variable Costs |

1 |

acre |

$10.00 |

|

$10.00 |

|

|

|

Operating Interest |

$453 |

dollars |

6.0% |

# Months |

8 |

$18.10 |

|

Total Variable Costs Per Acre |

|

|

|

|

$522.55 |

||

|

|

|

|

|

|

|

|

|

|

Return Above Variable Costs Per Acre |

$558 |

||||||

|

|

|

|

|

|

|

|

|

|

Budgeted Fixed Costs Per Acre |

|

||||||

|

|

Operator Labor (Fixed Only) |

|

|

$0.00 |

See Question Above |

$0.00 |

|

|

Machinery Depreciation and Overhead |

|

|

$0.00 |

$89.05 |

|

|

|

Taxes and Insurance |

1 |

acre |

$5.00 |

|

$5.00 |

|

|

Other Fixed Costs |

1 |

acre |

$5.00 |

|

$5.00 |

|

Return Above All Specified Costs |

$459 |

|||||

Footnotes:

1 Assumes urea (NH2). Adjust as needed for other forms of nitrogen.

2 Scout to detect any insect or disease problems and control as required.

3 Crop insurance varies substantially by policy type and coverage level.

4 Cash rent varies substantially by productivity level and region in Kentucky.

|

No-Till Cereal Rye \ Double-Crop Soybeans, Per Acre Costs and Returns |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

Quant. |

Unit |

Price |

|

Total |

|

|

Gross Returns Per Acre |

|

||||||

|

|

Cereal Rye |

50 |

bu |

$9.00 |

|

$450.00 |

|

|

|

Soybeans |

37 |

bu |

$9.20 |

|

$340.40 |

|

|

|

Crop Insurance Payment |

1 |

acre |

$0.00 |

|

$0.00 |

|

|

|

Gov't Program Payment |

1 |

acre |

$5.00 |

|

$5.00 |

|

|

Total Revenue |

|

|

|

|

$795.40 |

||

|

|

|

|

|

|

|

|

|

|

Variable Costs Per Acre |

|

||||||

|

|

Seed (Cereal Rye) |

68 |

lbs |

$0.70 |

|

$47.60 |

|

|

|

Seed (Soybean) |

1.00 |

bags |

$55.00 |

|

$55.00 |

|

|

|

Nitrogen1 |

80 |

units |

$0.43 |

|

$34.40 |

|

|

|

Phosphorous (P2O5) |

75 |

units |

$0.40 |

|

$30.00 |

|

|

|

Potassium (K2O) |

60 |

units |

$0.33 |

|

$19.80 |

|

|

|

Other Fertilizer |

0 |

units |

$0.00 |

|

$0.00 |

|

|

|

Lime - Delivered and Spread |

0.50 |

ton |

$20.00 |

|

$10.00 |

|

|

|

Herbicides |

1 |

acre |

$90.00 |

|

$90.00 |

|

|

|

Insecticides2 |

1 |

acre |

$5.00 |

|

$5.00 |

|

|

|

Fungicides2 |

1 |

acre |

$5.00 |

|

$5.00 |

|

|

|

Fuel and Lube |

1 |

acre |

$0.00 |

Calculate Machinery Related Costs? |

Y |

$23.77 |

|

|

Repairs |

1 |

acre |

$0.00 |

$53.29 |

||

|

|

Hired Labor |

1 |

acre |

$0.00 |

$0.00 |

||

|

|

Operator Labor (Variable Only) |

1 |

acre |

$0.00 |

$40.47 |

||

|

|

Machinery Rental |

1 |

acre |

$0.00 |

|

$0.00 |

|

|

|

Custom Work |

1 |

acre |

$0.00 |

|

$0.00 |

|

|

|

Drying(Cereal Rye): LP, Electric, Maint & |

1 |

gallon LP |

$2.00 |

Pts Remove |

1.0 |

$2.08 |

|

|

Crop Insurance3 |

1 |

acre |

$30.00 |

|

$30.00 |

|

|

|

Cash Rent4 |

1 |

acre |

$0.00 |

|

$0.00 |

|

|

|

Other Variable Costs |

1 |

acre |

$10.00 |

|

$10.00 |

|

|

|

Operating Interest |

$411 |

dollars |

6.0% |

# Months |

8 |

$16.42 |

|

Total Variable Costs Per Acre |

|

|

|

|

$472.84 |

||

|

|

|

|

|

|

|

|

|

|

Return Above Variable Costs Per Acre |

$323 |

||||||

|

|

|

|

|

|

|

|

|

|

Budgeted Fixed Costs Per Acre |

|

||||||

|

|

Operator Labor (Fixed Only) |

|

|

$0.00 |

See Question Above |

$0.00 |

|

|

Machinery Depreciation and Overhead |

|

|

$0.00 |

$85.70 |

|

|

|

Taxes and Insurance |

1 |

acre |

$5.00 |

|

$5.00 |

|

|

Other Fixed Costs |

1 |

acre |

$5.00 |

|

$5.00 |

|

Return Above All Specified Costs |

$227 |

|||||

Footnotes:

1 Assumes urea (NH2). Adjust as needed for other forms of nitrogen.

2 Scout to detect any insect or disease problems and control as required.

3 Crop insurance varies substantially by policy type and coverage level.

4 Cash rent varies substantially by productivity level and region in Kentucky.

Learning Outcomes

Events: Hosting the Southeastern Grain Gathering (SEGG) was a big accomplishment, especially given that it was held in the first year of the grant. The event was made possible by the networking efforts made prior to the awarding of the grant. Not only did the SEGG allow us to extend our network in Kentucky, perhaps more importantly, it enabled us to cast a wider net and establish relationships with growers, processors and end users throughout the region. Two examples illustrate the manner in which the SARE team has been able to make these connections: 1) farmer partner Walnut Grove Farms produced Edison hard white spring wheat in response to a baker request, and now the wheat is being sold to artisan bakers in KY, OH and TN; 2) an artisan miller/baker brought a stone mill to the SEGG to use in a class; the SARE team knew that an OH baker might be interested in buying the mill and was able to connect the two parties; the mill is now established in the OH bakery.

Interviews: The goal of objective 1 (mapping the value chain) was to identify critical success factors for specialty small grain markets to flourish in Kentucky. As a first step toward this goal, the SARE team conducted interviews with end-users of specialty small grains. These end-users included millers, maltsters, bakers, brewers, and distillers. Overall, we formally interviewed ten end-users (17 interview participants; Table 1) representing at least one from each of the categories mentioned above. Each interview was in-person and lasted 1-1.5 hours. We followed a semi-structured protocol that asked questions regarding the past, present, and future opportunities for specialty small grains grown in Kentucky (See Appendix 1 for interview protocol and sample questions). From these interviews, five themes arose:

1.) DEMAND: The strongest demand is from bakers and distillers; however, emerging enterprises in both milling and malting will demand more specialty small grains soon.

- Kentucky’s first malt house is expected to commence operations by barley harvest 2020 in Harrison County, Kentucky. Currently, the closest malt house for Kentucky producers is Riverbend Malt House in Asheville, NC.

2.) QUALITY: Grain quality standards for specialty grains are more stringent and less flexible than those for commodity grains. Moreover, these standards must be communicated to the end-users.

- Grain quality standards begin with USDA No. 1 Grade standards, with additional specifications for brewers and distillers.

- Quality labs for testing malt for brewers and distillers are located out of state.

- If quality standards are not met, an alternative market must be identified (e.g., animal feed).

3.) STORAGE: On-farm storage will be required to allow for just-in-time delivery to processors and other purchasing entities.

- Aggregators exist that will buy and store specialty grains (e.g., Brooks Grain in Jeffersonville, IN).

4.) FLAVOR: Flavor profiles of the grains are important; variety selection will necessarily encompass more than yield and disease-resistance.

- Variety selection will also include alcohol yield for distillers and brewers.

5.) RELATIONSHIPS: All stakeholders valued both professional and interpersonal relationships with farmers and suppliers. These relationships build a story that helps brand products and link the product back to Kentucky farms and their sustainable practices.

- Stakeholders are willing to work with farmers to ensure fair compensation and risk-mitigation when trying new or specialty grains.

- Stakeholders are looking to build a long-term, win/win relationship with farmers.

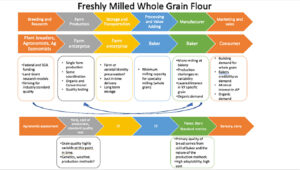

Details of the interview process are provided in the appendix.Enterprise Budgets: Mapping current and potential value chains for specialty small grains (Objective 1) requires

1. Assessing the market demand in Kentucky for locally sourced specialty small grains (hard red winter wheat, cereal rye, and malting barley) by end users (millers, bakers, maltsters, and brewers).

2. Developing enterprise budgets for specialty small grains, up through delivery to end-users, to understand the costs of production and profitability potential for producers.

Yields and production practices for hard red winter wheat, cereal rye, and malting barley are distinct from those for the traditional, soft red winter wheat grown in the state. By understanding these differences, we can adjust our current enterprise budgets for soft red winter wheat, to reflect growing specialty small grains in a double-crop system with soybeans. SARE team members discussed with UK agronomists knowledge of current yields and expected yields for specialty small grains as compared to soft red winter wheat. In general, yield estimates for specialty small grains are lower than that of soft red winter wheat. Given the current varieties tested in Kentucky, we estimate yields for hard red winter wheat, malting barley, and cereal rye to be 70 bu/ac, 65 bu/ac, and 60 bu/ac, respectively. In addition to specialty small grain yields, the yields on soybeans will change if following malting barley or cereal rye. If soybeans follow malting barley, a 7% yield increase in soybeans is estimated due to earlier planting (0.5% per day soybean yield increase). If soybeans follow cereal rye, a 7% yield decrease in soybeans is estimated due to later planting (0.5% per day soybean yield decrease).

In terms of production practices, hard red winter wheat and cereal rye have slightly different production practices (compared to soft red winter wheat); these would impact costs. Hard red winter wheat requires an extra application of nitrogen (20 lbs/ac) late in the season. Cereal rye has half the seeding rate requirement and a lower nitrogen rate than soft red winter wheat. All of the specialty small grains are estimated to have a higher seed cost than soft red winter wheat. A seed price per 50 lb. bag of hard red winter wheat, malting barley, and cereal rye are estimated at $34/bag, $30.50/bag, and $36.50/bag, respectively. For the remaining year, pricing data will be collected, and the enterprise budgets will be finalized.

Project Outcomes

We have had a positive response from growers to the specialty small grain research. This has come in the form of expressions of interest via our winter wheat meeting survey, phone calls and emails. The SARE team provided seed and production information to growers in KY and TN after SEGG. Variety information has been provided to growers interested in growing malting barley and several farmers have expressed strong interest in participating in the rye project. Currently there are 7 farmers in the project, up from 4 in 2019 and the plan is to grow the number to 20 in 2021. The SARE team has met twice with the Advisory Committee: once during the SEGG and in late February. In both instances we sought and received guidance as to our project direction and whether we needed to modify it. We plan to meet a third time in June 2020 just before wheat harvest to tour experimental plots and taste bread baked from specific varieties.

Team member Lilian Brislen played a key organizing role in an effort funded by USDA’s Agricultural Marketing Service to create an online resource for local food systems impacted by Covid-19 (https://www.ams.usda.gov/content/usda-launches-resource-hub-local-food-system-response-covid-19). One of the outcomes of this AMS grant was a document that described Neighbor Loaves, a program organized by the Artisan Grain Collaborative (http://graincollaborative.com/neighbor-loaves/). Our grant team has worked to get a Neighbor Loaves program established in Kentucky; to date two local bakeries are baking sandwich loaves, the majority of the flour for which comes from locally grown and milled wheat. These loaves are purchased by customers and donated to local food banks. Our hope is to grow this program to other bakeries throughout the state.

Grant team member Shockley spoke at the Colorado Grain School virtual meeting in Colorado to 160 participants and presented his work on Enterprise Budgets, which relates to project Objective 1 Mapping current and potential value chains for specialty small grains. Furthermore, Shockley presented market demand and economics of specialty small grains to 90 county agents in Kentucky as well as to a group of farmers in the Central Kentucky region, home to our vast bourbon industry.

During the course of this grant, a project under the auspices of American Farmland Trust (AFT), aimed at bringing rye back to Kentucky has been initiated: The Kentucky Commercial Rye Cover Crop Initiative - https://farmland.org/project/kentucky-commercial-rye-cover-crop-initiative/ Now 27 farmers strong, this project involves several of our SARE team members and overlaps with a number of our grant objectives. Several of the farmers in the rye project are also interested growing wheat for local bakeries and malting barley for local breweries and distilleries and two of the AFT principals serve on our grant’s advisory committee. Our team updated and expanded the Kentucky small grains stakeholder map, working with AFT leaders of the Rye project, to collect and integrate participating farmers. We have initiated discussions with AFT leadership in hopes of conducting interviews with rye farmers.

Our team has also:

• Worked with Maker’s Mark distillery to evaluate wheat varieties as flavoring agents by growing a wheat variety trial planted on their distillery campus and generating grain samples for the distillery to subject to sensory evaluation and potential pilot distillation.

• Facilitated a linkage between Kentucky’s Walnut Grove Farms and Sixteen Bricks bakery in Cincinnati and Bluegrass Baking in Lexington in which the farmer is providing the bakers with locally grown wheat and rye for baked goods.

• Initiated conversations with Aramark, University of Kentucky’s dining service provider, about development of locally sourced bread products for integration into campus dining operations. 16 Bricks Bakery has so far developed several products for testing, and conversations continue with UK dining. With over 11 million dollars in annual food procurement, the potential for this partnership is significant.

• Conducted interviews with 3 national partners engaged in on-site milling for locally grown small grains. A case study is currently in the final stages of authorship.

• Developed an introductory video covering the principles of value chain coordination as it relates to a small grains systems. Revisions are in process, as well as additional detailed topical discussions.

Appendix 1: Interview Protocol

INTRO

We’ve prepared a series of questions that cover different dimension of small grain purchasing, assessment, usage, and possible future use.

It’s totally fine and understandable if you don’t know some of the answers – we’re covering a lot of ground as we try to map out the value chain.

We’re also happy to be as specific or general as feels comfortable to you – meaning, we don’t want to reveal any trade secrets. I totally understand if you’d like to pass on a question or circle back at some other time.

We’re just here to get a sense of what we should take into consideration as we’re working with everyone across the small-grain value chain to develop seed stock, farm management practices, or different ways of assessing and managing small-grains that will open up as many chances for innovation or creativity as possible.

Business Basics

- Can you give me the readers digest version of the story of this business? (history, product lines, what markets to they sell into (local, national, global)

- What distinguishes your company’s products or brand from others?

- How strongly is the company’s identity or brand tied to “Kentucky”?

- How would you describe your typical or best customer?

Grain Basics

- What small-grains does you company use (wheat, barley, rye), and how do you use them?

- Where are you currently sourcing those grains from?

- Direct from a farm, from a merchandiser such as a grain elevator, or from an intermediate processor, such as a miller or malthouse?

- Are any of your grains currently coming from Kentucky?

- If you are not already buying raw product from farmers, are there any plans to do so in the future?

- Do you buy grain through contracts with suppliers, on the open market, or through some other pricing method?

- Speaking in generalities, how is price you pay for grain, flour, etc. determined?

- Who pays for transportation, and are you taking deliveries or picking it up yourself?

- What’s your Plan B for grain sourcing?

- What options are available if you source grain that does not meet your needs (e.g., discounts, change supplier, adapt recipes, etc.)

Volume and Storage

It’s not secret that the volume of purchasing by any given producer drives a lot of other considerations for small-grain supply chains.

- Can you give me a rough idea of what sorts of volumes of each of the small-grain your purchasing, and does that fluctuate over the course of the year?

- Do you or your suppliers consider yourself a small, medium, or large grain buyer?

How about storage? How do you all receive your small-grains, and what sorts of storage infrastructure (if any) do you have at your facilities? How often does that stored small-grain inventory turnover?

Quality Standards

- How do you assess the quality of the small-grains you work with?

- Are there industry standards, or do you have any unique or extra requirements?

- We’re not looking for trade secrets, just to know if standards vary by manufacturer

- Thinking about the quality assessment measurements, what aspects of your product or your production process do they affect? Meaning, why are they important?

- For your products and business, what are the tolerances for variation in grain delivery schedules, quantity, and storage?

- How much do those dimensions of ‘quality’ impact the flavor of your product, or other distinguishing characteristics?

Specialty grains/products

As you know, our research is looking specifically at Kentucky-grown small grains. One question we’re particularly interested is what – if any- unique value can Kentucky-grown grains bring to the table (pun intended).

- Can you walk me through a time you company experimented with a special product or unique offering?

- How did the decision to explore that product come about?

- Who was involved, and how did the decision making happen?

- Did you encounter any unique barriers or challenges?

- Did you ultimately move ahead to production, or did it end in the development stage?

- What did you learn?

- Do you currently order and premium or specialty small-grains to meet specific needs/goals? Have you ever considered doing so?

- What kids of specialty standards or needs do you have? What do they bring to your product?

- Thinking both of general characteristics and specialty grains, what quality benchmarks would Kentucky grains need to meet to be suitable for your products (moisture content, protein content, baking properties, others)?

- Is small-batch production typical or feasible? What is the lower limit of grain purchases you can make in your operation?

Kentucky Value-add

- How strong do you think your customers’ demand is for products using Kentucky grains?

- Are there other value-added product attributes that your customers demand more?

- Would some local grain products be more attractive to customers than others?

- What information do you need to make a business decision about whether to source grain (or flour or malt) from Kentucky?

Looking to the future

- What aspects of the business are really dialed in, and where do you see areas of growth or experimentation?

- Do you see a place of Kentucky-grown grains in any piece of that growth or innovation?

Misc

- What other barriers to sourcing Kentucky grains are we not thinking of?

- Given your expertise in your business compared to our lack of familiarity, what issues have we not yet talked about that we should be paying attention to?

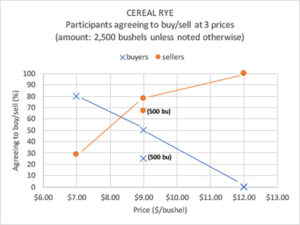

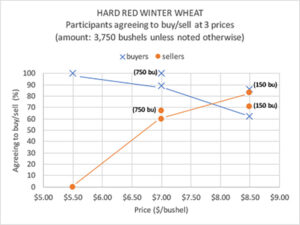

Cereal rye and hard red winter wheat: Price discovery (Based on an exercise carried out at the Septmember 2021 gathering at Henton Farms.)

Yoko Kusunose

Jordan Shockley

Brett Wolff

What’s a reasonable price?

A farmer knows their marginal cost for growing a crop; they need to receive a price that covers this. Similarly, someone looking to purchase a crop also knows the maximum that they can pay. Normally, buyers and sellers decide whether to enter markets by comparing these values to the market price. But what if market prices are unknown?

Price discovery requires ‘thick’ markets. Markets for many specialty crops are often ‘thin;’ this is particularly true of malting barley, cereal rye, and hard red winter wheat, none of which are commonly grown in Kentucky. Nonetheless, the SARE project team, with the cooperation and good humor of some of the buyers and sellers who do exist in Kentucky, came up with estimates of ‘reasonable prices’ (in 2021) for rye and hard red winter wheat.

How did we do this?